Raising $1 Million for My Real Estate Deal: Overcoming Hurdles as a First-Time Capital Raiser

Raising capital for the first time can seem daunting, but with the right preparation and persistence, it is possible. As a new real estate investor seeking $1 million for my next deal, I know I have some mental hurdles to overcome. By thinking through key questions and developing a strategy, however, I can position myself for success.

To start, I need to thoroughly prepare for each investor conversation. This includes researching the investor’s prior deals and preferred investment types. I’ll tailor my pitch accordingly, highlighting the key points that matter most to that particular investor. I’ll practice my pitch multiple times so I can present confidently.

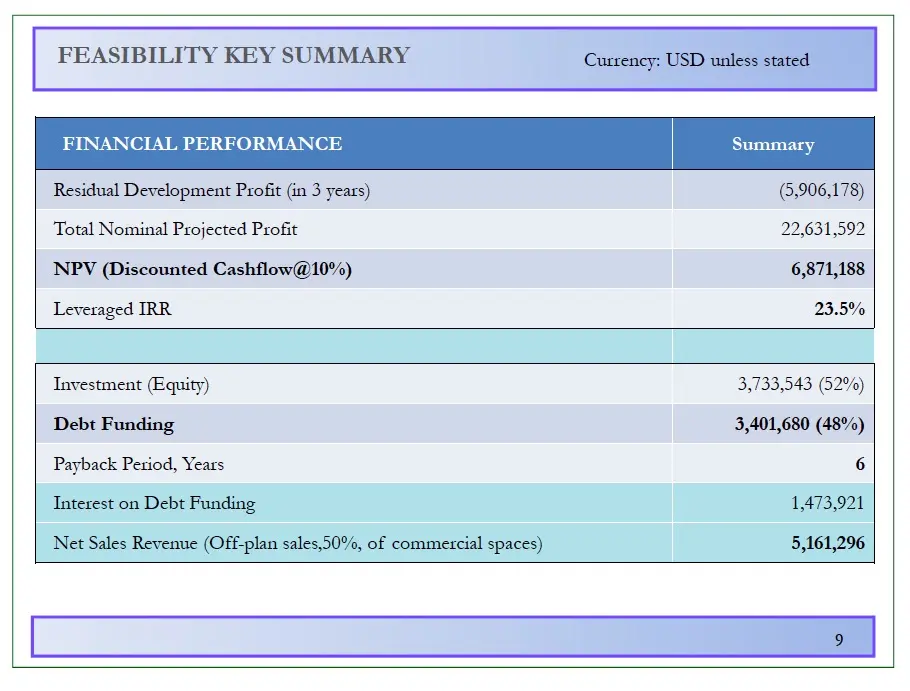

During the presentation, I’ll need to succinctly yet compellingly communicate the deal’s financials and projected results. Investors will want to know the capitalization rate, cash-on-cash return, debt service coverage ratio, loan terms, exit strategy, and estimated profit and timeline. I’ll prepare a one-page deal summary and presentation to communicate this clearly.

Raising capital does involve risks, like any investment. I need to be upfront about the risks involved in this deal, such as delays in securing permits or unforeseen repairs. Savvy investors will respect this transparency. I can demonstrate my experience managing risks by highlighting past deals successfully executed.

To raise capital legally, I’ll form an LLC and offer potential investors private placement memorandums with disclaimers as appropriate. I’ll be careful not to implicitly or explicitly promise returns. I’ll also research state and federal regulations to ensure compliance.

Differentiating myself will also be critical. With many real estate deals competing for capital, I need to stand out. I plan to do this by leveraging my strong credit score, real estate license, and background managing residential properties. My attention to detail and financial prudence are useful selling points.

Proper structuring of my LLC will also provide investor confidence. I’ll document thorough operating procedures and opt for regular audits. Airtight recordkeeping and financial controls will show I’m operating professionally.

Ultimately, investors invest in people. To build trustworthiness, I’ll be transparent about my background and past deals. I’ll provide references to give insight into my character. My integrity and desire to create a win-win relationship will shine through.

Raising $1 million is bold but attainable. With diligent preparation and a compelling pitch, I can overcome the hurdles of an inexperienced capital raiser. I’m ready to put myself out there, build relationships, and actualize a lucrative deal. The time is now. My thoughtful strategy will turn investors into partners for long-term success. N

Next is the strategy to raise $10 million! Contact me if you want to learn more!

To Your Success!

Bert Bykes @ Contact

MORE INSIGHTS…

Let’s Do Something Together!

Have a project or an idea then get in touch with us and we shall WORK WITH YOU to create your dreams!

OUR OUTPOSTS

Bangkok | Bali

![]()